Direct Buyer of Junior Liens: UPB < $50K • SFR Only • No Brokers

Sell your non-performing junior notes directly to us—typically closing within 14 days. Specializing in small-balance notes ($1K-$50K UPB) on single-family residences.

Your Trusted Partner in Non-Performing Notes

Preliminary offer within 🕒 24 hours of submission

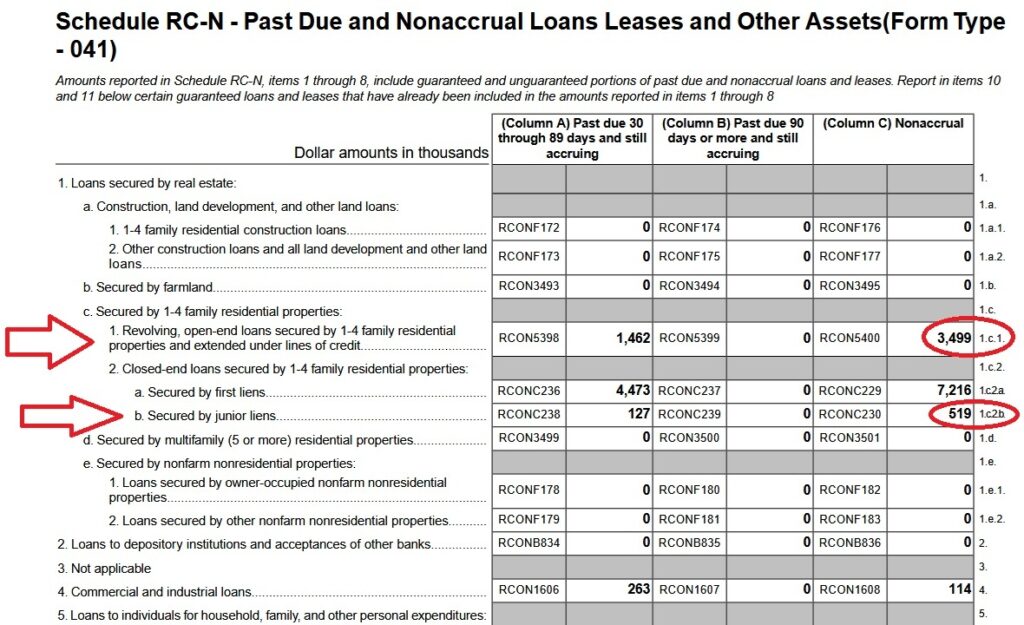

If your Consolidated Reports of Condition and Income reflect a high volume of non-performing assets, we can provide a solution. We specialize in selectively purchasing institutional junior non-performing notes, especially with low unpaid principal balance, including those tied to single-family residences across all states. As direct buyers, not brokers, our priority is acquiring NPNs straight from sellers, and we operate exclusively after signing an NDA. We focus solely on non-performing opportunities. With our expertise and personalized approach, we offer a seamless process to help you clear your portfolio. Contact us today to explore how we can maximize value for your organization.

When acquiring a non-performing note, we prioritize working with borrowers to explore all viable options for resuming payments, even if partial. Foreclosure is considered a last resort, not a primary objective.

Why Choose CTIG?

Submit Note Details →

Get offer in 24 hours

• Specialization: We focus on junior NPNs with low UPB, enabling you to efficiently clear challenging assets from your portfolio.

• Flexibility: Our agile team adapts to your needs, ensuring a smooth process.

• Confidentiality: Every deal begins with an NDA to protect your sensitive data.

• Efficiency: Fast evaluations and closings minimize your administrative burden.

Notes We Purchase:

✅ Junior liens (2nd/3rd position)

✅ UPB: $1,000 – $50,000

✅ Single-family residences only

✅ 180+ days delinquent

❌ No broker-submitted notes

❌ No “performing” notes

❌ Excluded States: Georgia, Massachusetts, Maryland, Ohio, Illinois.

Benefits for Banks and Credit Unions

- Free up capital: Offload non-performing assets to improve your balance sheet and reallocate resources to performing loans.

- Fast and efficient transactions: Our optimized process allows us to close deals within 14 days, reducing your administrative burden.

- Competitive pricing: Receive fair, market-based offers backed by thorough due diligence.

- Trusted partner: Work with a reliable buyer who understands regulatory requirements and maintains confidentiality.

Benefits for CTIG

- Access to proven assets: We acquire junior NPN portfolios that align with our investment strategy, enabling us to generate value through restructuring or resale.

- Strengthened relationships: We build long-term partnerships.

- Market expertise: Enhancing our asset valuation accuracy.

Working with industry leaders: PNC Bank, US Mortgage Resolution Trust, FIXnotes